Federal K1 Form : Is A Schedule K 1 By Itself Enough To Prove Llc Membership New York Business Divorce : We won't go into too much detail here.

Federal K1 Form : Is A Schedule K 1 By Itself Enough To Prove Llc Membership New York Business Divorce : We won't go into too much detail here.. Ending / / partner's share of income, deductions, credits, etc. Column (c) shows the difference between federal and california amounts. We won't go into too much detail here. Level 15 september 5, 2019 8:19 pm. What is the k1 tax form?

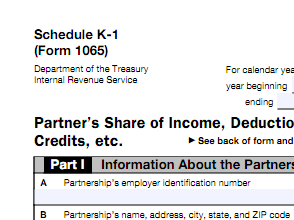

Part i information about the partnership. Talk to your accountant to see if this applies to you. An estate or trust that generate incomes of $600 or more and estates with nonresident alien beneficiaries must file a form 1041. Department of the treasury internal revenue service. What is the k1 tax form?

Ending / / partner's share of income, deductions, credits, etc.

What is the k1 tax form? An estate or trust that generate incomes of $600 or more and estates with nonresident alien beneficiaries must file a form 1041. The schedule k1 tax form indicates one's share of an estate/trust, partnership, or corporation. Part i information about the partnership. Ending / / partner's share of income, deductions, credits, etc. Before beginning the import, verify the following information the federal business (1065, 1120s, 1041 or fiscal 1041) return must be completed in the current year program. Income, credit, deductions, and other items. Complete irs tax forms online or print government tax documents. We won't go into too much detail here. Box 9, for example, shows the amount of depletion, depreciation and amortization deductions allocated to you. Your state might have its own way of treating inheritances. The s corporation files a copy of this schedule with the irs to report your share of the corporation's income, deductions, credits, etc. Income tax return for estates and trusts 2020 12/09/2020 inst 1041:

Complete irs tax forms online or print government tax documents. Income, credit, deductions, and other items. Part i information about the partnership. Box 9, for example, shows the amount of depletion, depreciation and amortization deductions allocated to you. Before beginning the import, verify the following information the federal business (1065, 1120s, 1041 or fiscal 1041) return must be completed in the current year program.

Pennsylvania, new jersey, maryland, iowa, kentucky and nebraska all had an inheritance tax as of november 2020.

If beneficiaries receive the income established from a trust or estate, they must pay the income tax on it. Column (d) shows your total amounts using california law by combining column (b) and column (c). Instructions for form 1041, u.s. Column (c) shows the difference between federal and california amounts. Before beginning the import, verify the following information the federal business (1065, 1120s, 1041 or fiscal 1041) return must be completed in the current year program. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. What is the k1 tax form? Part i information about the partnership. The s corporation files a copy of this schedule with the irs to report your share of the corporation's income, deductions, credits, etc. The k1 tax form signifies the transfer of tax responsibility from the person or company earning income to the one who actually benefits from it. Pennsylvania, new jersey, maryland, iowa, kentucky and nebraska all had an inheritance tax as of november 2020. Talk to your accountant to see if this applies to you. Level 15 september 5, 2019 8:19 pm.

Level 15 september 5, 2019 8:19 pm. Box 9, for example, shows the amount of depletion, depreciation and amortization deductions allocated to you. The k1 tax form signifies the transfer of tax responsibility from the person or company earning income to the one who actually benefits from it. Talk to your accountant to see if this applies to you. Income tax return for estates and trusts 2020 12/09/2020 inst 1041:

Both forms are statements of income, expenses, deductions and credits.

An estate or trust that generate incomes of $600 or more and estates with nonresident alien beneficiaries must file a form 1041. For calendar year 2020, or tax year beginning / / 2020. Before beginning the import, verify the following information the federal business (1065, 1120s, 1041 or fiscal 1041) return must be completed in the current year program. Complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Column (c) shows the difference between federal and california amounts. Pennsylvania, new jersey, maryland, iowa, kentucky and nebraska all had an inheritance tax as of november 2020. Income, credit, deductions, and other items. Instructions for form 1041, u.s. If beneficiaries receive the income established from a trust or estate, they must pay the income tax on it. Level 15 september 5, 2019 8:19 pm. Part i information about the partnership. Ending / / partner's share of income, deductions, credits, etc.

Komentar

Posting Komentar